Bond Programmes

Global Medium Term Notes (GMTN)

Established in 2011, our USD 3bn Global Medium Term Note Programme currently has USD 800mn of securities outstanding, which mature in May 2024. The programme is listed on the Euronext Dublin and NASDAQ Dubai.

Sukuk

Our USD 3bn Trust Certificate Issuance Programme has USD 1.8 bn of Sukuk certificates outstanding, including the two Green Sukuk instruments issued in 2019. The notes have maturities ranging from October 2025 to February 2030. The programme is listed on the Euronext Dublin and NASDAQ Dubai.

Subordinated Perpetual Notes

We have USD 900mn of Subordinated Perpetual Notes outstanding; USD 500mn issued in March 2017 and USD 400mn issued in March 2018. The notes are listed on the Euronext Dublin and NASDAQ Dubai.

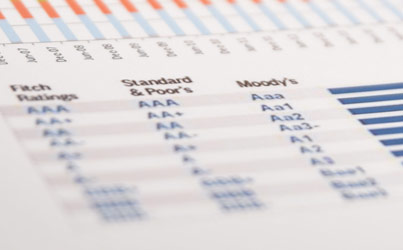

Credit Rating

S&P

With a BBB credit rating from Standard and Poor’s Ratings, we continue to be the highest rated private company from the region.

Fitch

With a BBB credit rating from Fitch Ratings, we continue to be the highest rated private company from the region.

Green Finance Framework

Green Finance Framework

Majid Al Futtaim has opted to develop a Green Finance Framework, under which it may issue Green Bonds or Green Sukuk as part of its commitment to leadership in sustainability in the global marketplace. The Framework has been designed in accordance with the Green Bond Principles 2018.

X